Medtech Monitor Weekly: Thermo Fisher Buy Solventum's Filters for $4.1B and Tandem Received FDA Approval for AID System in Type 2 Diabetes

Thermo Fisher to Acquire Solventum’s Purification and Filtration Unit for $4.1B

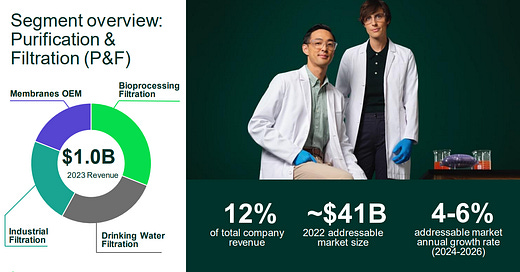

Thermo Fisher Scientific has agreed to acquire Solventum’s purification and filtration business for $4.1 billion in cash. The unit, which supports biologics, medical devices, and industrial applications, generated approximately $1 billion in revenue last year and employs 2,500 people globally. It will be integrated into Thermo Fisher’s life sciences solutions segment.

Thermo Fisher CEO Marc Casper stated that the acquisition complements the company’s bioproduction business, which includes cell culture media and single-use technologies. Solventum’s filters and membranes are widely used in biopharmaceutical manufacturing, medical technologies, microelectronics, and food and beverage production. Thermo Fisher expects the addition to enhance its biologics development and manufacturing capabilities, drive mid- to high-single-digit organic growth, and enable strong margin expansion.

According to Leerink Partners analyst Puneet Souda, the deal strengthens Thermo Fisher’s position in bioprocessing, particularly in filtration, where competitors like Danaher and Repligen currently lead. Thermo Fisher, which has traditionally focused on cell culture media and single-use plastics, is now expanding its footprint in this critical category.

Analysis: Thermo Fisher Scientific is a biotechnology and life sciences powerhouse, providing laboratory equipment, analytical instruments, reagents, software, and services to support research, diagnostics, and pharmaceutical development across industries like healthcare, academia, and environmental science. Most scientists encounter Thermo Fisher early in their careers, it's pretty much seen as the Walmart of laboratory supplies, selling a vast array of consumables and analyzers. However, over the past decade, the company has been making a deliberate push into bioprocessing, a field more associated with the manufacturing of pharmaceutical and biologic products.

A key part of Thermo Fisher’s strategy has been acquiring CDMOs (Contract Development and Manufacturing Organizations) and CROs (Contract Research Organizations), which provide outsourced services for drug development and manufacturing. Notable acquisitions include Patheon in 2017 and PPD in 2021, both of which bolstered Thermo Fisher’s capabilities in supporting pharmaceutical companies from early-stage drug discovery through clinical trials and commercial production. CDMOs handle drug development and manufacturing, streamlining processes and reducing costs, while CROs provide research expertise, clinical trial management, and regulatory support. By integrating these services, Thermo Fisher has positioned itself as a one-stop-shop for biopharma companies, offering end-to-end solutions to bring new therapies to market more efficiently.

This aggressive expansion into bioprocessing is exactly where Solventum’s filtration portfolio fits in. If you’re wondering who the heck Solventum is and how they quietly built a $1 billion filtration business, you’re not alone. Solventum is the healthcare spin-off of 3M, a company with a long history in filtration and membrane technologies. With this sale finalized (which was likely in the works even before the spinoff), Solventum will now be heavily focused on medical devices, particularly in the wound therapy market.

To understand why this deal is a logical next step for Thermo Fisher, it’s helpful to break down the basics of bioprocessing. Bioprocessing consists of two major steps:

Upstream processing: Everything leading up to and including the production of the target biologic. It starts with cell line development, where genetically engineered cells (e.g., CHO cells) are optimized to express a desired protein. These cells are then cultivated in bioreactors under tightly controlled conditions (nutrients, oxygen, pH) to maximize yield. This phase also involves media preparation, cell expansion, and process optimization to ensure efficient growth and protein expression.

Downstream processing: The purification and formulation stage. It begins with cell lysis or separation (e.g., centrifugation or filtration) to isolate the desired product. The biologic then undergoes purification steps like chromatography and ultrafiltration to remove contaminants and ensure high purity. Finally, the product is formulated, stabilized, and packaged for storage and distribution, ensuring it meets clinical and commercial standards.

Visual representation of the bioprocessing steps: Source

Think of upstream as setting up a tiny antibody factory, you’re choosing the best worker cells, feeding them, and making sure they’re cranking out as many antibodies as possible. Downstream is the cleanup phase, like sorting through a below average child art project, removing all the leftover glue, paper scraps, and paint to ensure only the pure, final masterpiece remains. In simple terms, upstream is about making the product, and downstream is about purifying and refining it.

Now, looking at where filtration fits into this, it’s clear why Solventum’s technology is so valuable. Downstream processing relies heavily on filtration and purification, ensuring drug products meet the highest purity standards. This isn’t some hidden industry secret; major bioprocessing players like Sartorius, Cytiva, Merck KGaA (MilliporeSigma), and Repligen all have strong filtration capabilities. Thermo Fisher, which had traditionally been more focused on cell culture media and single-use plastics, is now making a bigger play in downstream processing. This acquisition strengthens Thermo’s position in bioprocessing and allows it to compete more directly in the filtration space, further expanding its footprint across the entire biologics manufacturing workflow.

In short, this deal just makes sense, especially for Thermo Fisher, and this is only the only at-scale filtration asset not within a direct competitor, so to get it not at an astronomical price is a great pickup.

Tandem Diabetes Gains FDA Approval for Automated Insulin Delivery in Type 2 Diabetes

Tandem Diabetes Care has received FDA clearance for its Control-IQ+ algorithm in Type 2 diabetes, expanding access to automated insulin delivery (AID) systems. The technology integrates with Tandem’s insulin pumps, including the t:slim X2 and the smaller Tandem Mobi, to automatically adjust basal insulin delivery based on data from continuous glucose monitors (CGMs).

Tandem’s system is now the second FDA-cleared AID system for Type 2 diabetes, following Insulet’s Omnipod 5, which received an expanded indication last summer. Insulet executives see Type 2 diabetes as a key growth driver, with these users making up more than 30% of new customers in Q4 2024. CFO Ana Maria Chadwick noted that the expanded indication is expected to significantly contribute to revenue in 2025, though specific projections were not disclosed.

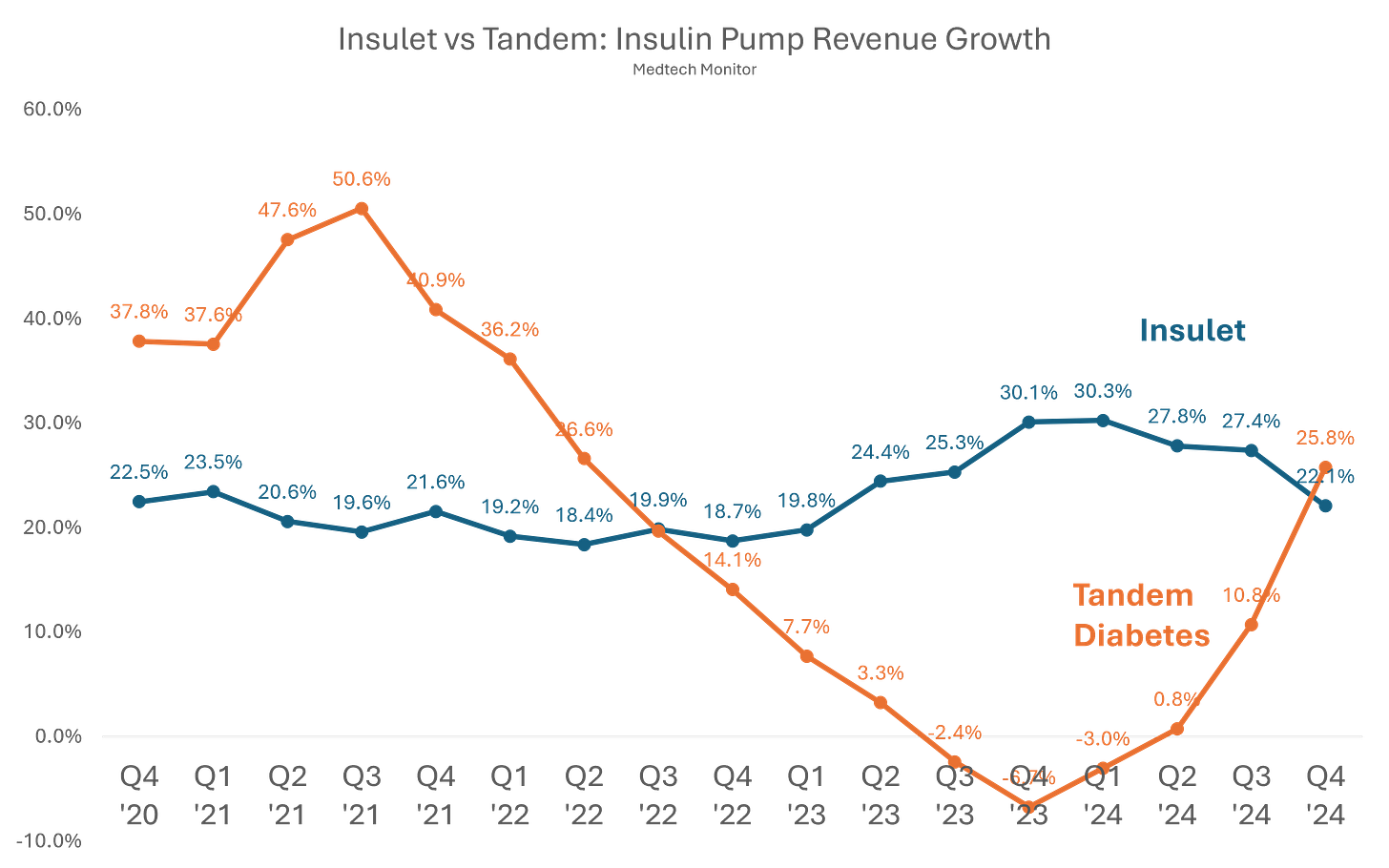

According to Insulet, approximately 2.5 million people in the U.S. with Type 2 diabetes require multiple daily insulin doses, while another 3 million use basal insulin only. In 2024, Tandem reported $940.2 million in revenue, marking 26% year-over-year growth. The company projects 2025 sales between $997 million and $1 billion. Meanwhile, Insulet’s revenue grew 22% to $2.1 billion in 2024, with expected growth of 16% to 20% in 2025.

Analysis: With the power of Mobi, Tandem is back in the insulin pump race! The Tandem Mobi has been the key growth driver, standing out as the smallest and most discreet tubed insulin pump. It features Tandem’s Control-IQ technology, an automated insulin delivery (AID) system that adjusts dosing based on CGM data. The pump is waterproof, rechargeable, and offers a short 5-inch tubing option for flexible wear. FDA-approved in July 2023 and launched in February 2024, the Mobi provides a compact, convenient alternative to traditional insulin pumps while maintaining advanced automation.

It’s been a wild ride for Tandem, for as recently as Q1 2024, the company was reporting negative revenue growth, which is a tough look when Insulet has been consistently delivering 20%+ growth quarters. But for the first time in over two years, Tandem actually outpaced Insulet in revenue growth. That said, Insulet has nearly doubled in size compared to Tandem, and this may just be a Mobi honeymoon period. While a positive sign, it might not last, as Tandem is forecasting ~6% growth for 2025, while Insulet projects 16%-20%. That’s a surprising gap heading into 2025, and it raises questions about whether Tandem is underestimating the impact of its Type 2 approval. Insulet has explicitly stated that 30% of its new users are coming from that patient population, if Tandem experiences a similar trend, a 6% growth rate would be a shockingly low target.

With both Tandem and Insulet reporting earnings, we now have updated financials across all major diabetes medtech players. Thanks to its strong quarter, Tandem currently sits atop the Diabetes Medtech Monitor What-Have-You-Done-For-Me-Lately Growth Rankings (name still workshopping). As mentioned in previous newsletters, Medtronic remains at the bottom, but at least they’re staying competitive, which, in this market, is still a solid growth driver.

Looking at overall revenue trends, Abbott remains dominant as the volume leader in CGMs, while Dexcom has now stumbled for multiple quarters. Medtronic has been stuck in a holding pattern, though recent trends are showing some improvement. Insulet remains rock steady, and Tandem continues to be a rollercoaster ride.

With 2025 shaping up to be a crucial year, the battle between Tandem and Insulet is far from over, but right now, Mobi has given Tandem a much-needed boost. The question is: can they keep the mo(bi)mentum going?